cannabis conversation: inventory challenges and how to account for it

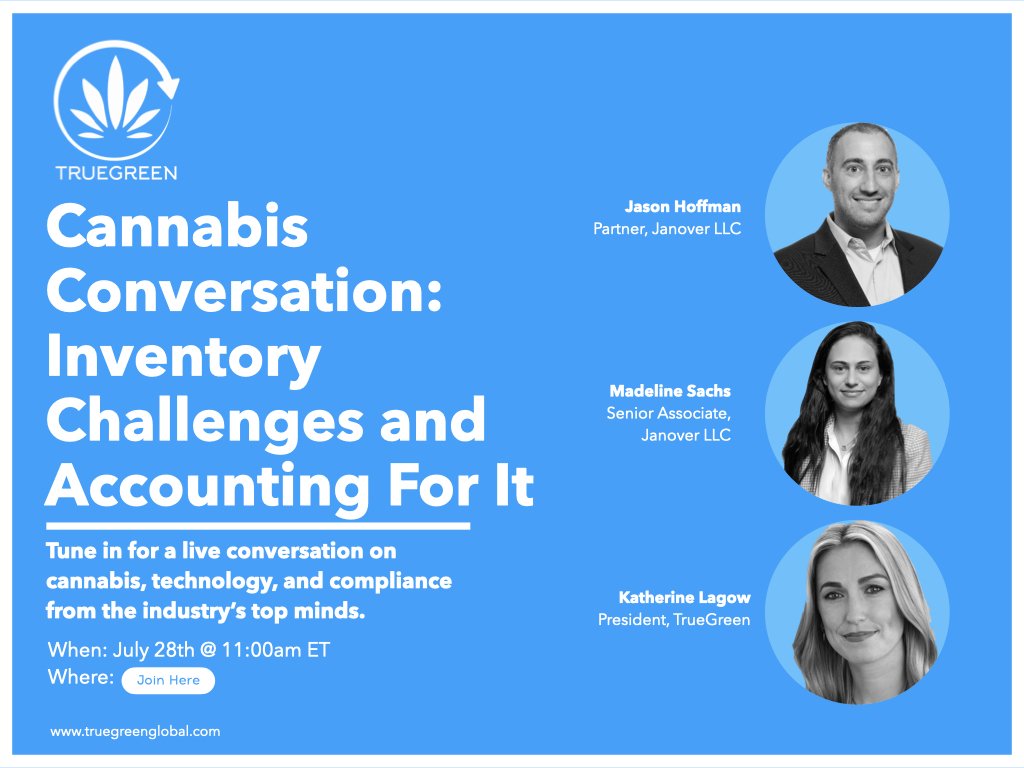

@TrueGreen today we are talking accounting in cannabis. Jason and Maddie both work for Janover. I first came across Janover and I guess Jason, technically, probably five years ago when I was still an operator. We started using them for most of our accounting and modeling in different areas at Standard Wellness, and have just stayed in touch, love working with them.

TrueGreen: All right. We are talking accounting in cannabis. Jason and Maddie both work for Janover. I first came across Janover and I guess Jason, technically, probably five years ago when I was still an operator. We were writing a Utah application, and the group we were working with used Janover to help with some of the modeling and then liked Jason and his team a lot. We started using them for most of our accounting and modeling in different areas at Standard Wellness, and have just stayed in touch, love working with them. I'll let Jason and Maddie, both introduce themselves and then talk a little bit about what Janover does in the cannabis space.

Jason: Sounds good. My name is Jason. I'm a partner at Janover. I run our cannabis and our real estate practice groups. About 10 years ago, some friends of mine were trying to get into cannabis work and they asked me to be their CPA. I was hesitant at first with everything I was reading, but I jumped into it. I had a knack for it. It went really well. I came to Janover about four-and-a-half years ago to open up a specific cannabis practice group. About the same time I met Catherine.

It's been great so far. We have some of the biggest clients in the country on the cannabis side. Our clients operate in 26 states. Janover only has offices in New York City and Long Island, but we do operate all over the country. With that, we like to help out in all areas of our clients from application that Catherine mentioned all the way through tax structuring, tax returns, audits, financials, and we really try to make a partnership with our clients. That's the 100-foot view of Janover and myself. I'll let Maddie talk about herself for a second.

Madeline: Hi. I also go by Madeline Sachs. I've now been at Janover for two years. I have had a history of focusing on high net worth and closely held businesses. Through working in cannabis, I try to help women and minorities specifically, which has been a rewarding process for me.

Facilitator: Nice. Very nice. All right. I think we're going to cover the gamut today on a few things, inventory being the bulk of it, but we'll get into that in a few minutes. I think starting out, one of the hot-topic things that cannabis companies are getting into, as I'm assuming other industries as well, is the Employee Retention Credit program. I know you guys have a lot of experience in that. Maybe just touch on how that's been working for you and then I'll have a couple follow-up questions as well.

Jason: The Employee Retention Credit is actually amazing for cannabis specifically since most credits that the IRS gives out or the Congress presents has to do with the income tax code. As everyone knows, the 280E, you're really not allowed to take any kind of credit against your income taxes, but this was a payroll tax credit that came out of some of the bills that were intended to help employers and employees during the pandemic. Because it was written as part of the payroll tax code, this is not something that's disallowed for cannabis.

Once we figured that out, we started really trying to help our clients first. A lot of our clients got a lot of money. We did applications, millions and millions of dollars worth of refunds. Since then, a lot of companies are out there doing it. I would recommend that if one company tells you it's not possible, get another company to just check it. There's a lot of money out there and we all know that the cash flow of cannabis companies isn't always as good as- we'll talk about this a little later, but isn't always as good as people think because of the taxes.

This is one area you can get up to $36,000 per employee. Again, there's a lot of calculations that go into it but I think every cannabis company out there should 100% be reaching out to their advisors, feel free to reach out to us. Catherine can connect you to other people, including us, but this is something that you don't want to miss. Most cannabis manufacturers, processors, and retailers should be able to get a nice chunk of change from this. It's not one set of rules that you can qualify by. The easiest way is to qualify if you have a certain reduction in your gross revenue but that is not the only way to qualify.

We really want to make sure that everyone on the call and everyone listening to this really understands that they should talk to somebody that's an expert in it, and not just assume they're not qualified. Also, time is of the essence because it started in 2020 and it's starting to close off. As it gets certain days away from the end of certain quarters, you can't apply for it anymore. Time is of the essence. Email us, email your advisors, get in front of it. There's millions upon millions upon millions of dollars out there for this.

TrueGreen: In that same vein, let's say you file one for TrueGreen today, how long should a company expect before they get that cash? What's the timeline here?

Jason: We've seen some people get it in as quick as two to three months and some are still waiting, eight, nine months now. What we do is, we actually paid for a system here at Janover that we can connect with the IRS directly. We actually pay the IRS as a third party, but they get us in front of someone specifically at the IRS once it takes too long.

The majority of the ones that we really push for in the beginning of this got the vast majority of their money back, maybe not all the payroll tax quarters back, but the millions upon millions of dollars are flowing in. I think the larger it is probably the longer it'll take to get your money.

TrueGreen: Okay. Seems to be, about average, six months, it looks like. Thanks. Okay. I think like so many things in this industry, people being cautious of the snake oil salesmen and people that reach out to you and say, "Hey, I can do this for you," or, "Hey, have you done this?" I think you guys have some experience with cleaning up the messes in this vein of people-- I won't name names, but I know a couple of stories about having to clean up the mess once a company thought, "Oh, I can deal with these guys. It's cheaper, they'll get it done," and then had to come back to you at the end anyways to get it fixed.

I don't know if you want to touch on that for a second, but just to understand the soliciting that's going on for this.

Jason: Sure. I know one or two of the ones that you're talking about. We're not pushy. We will tell you what we can do for you. We'll tell you how much it's going to cost. We really don't try to overfill but there are a lot of vultures out there that they see this PPP money that came in and ERC, Employee Retention Credit, money coming in. They see it as an opportunity for them to really just raked people over the coals for fees. We don't but two of our clients decided to go with one of those firms, other, I call, the vulture firms. I don't like to use names or anything.

Basically after waiting about eight months for them to actually do the work, they decided to fire them and move on to us. We got the work done. Almost, I think, two or three weeks later, we were done with it and both of those clients already have gotten their money now. I will say now it's really important that you work with someone that's going to do the work quickly just because time's running out. The IRS doesn't care that you hire somebody and they didn't do the work.

Once again, in cannabis specifically, there really is a lot of that that goes on. Catherine, you know it, we've spoken about a few different companies that have had this issue. It's not just with the ERC money or whatever, they pay the top consulting in cannabis to do an application and then they're shocked when they don't get it, or they're shocked that the business plan gets ripped apart by an investor or a potential investor or something. It's just something that happens to cannabis.

I always recommend trying to work with a group either a known CPA firm or a known group that doesn't only do cannabis, or a cannabis group that has such a great reputation that you're okay with. Just with anything in cannabis, I always recommend that.

TrueGreen: I'll triple down on that. All right. Then let's transition a bit to talking about inventory. I think it's a really big topic. Whether we're talking about an operator from a cultivation and processing standpoint, or the dispensary standpoint, the issues are much different. Jason, we've talked a lot about the valuing, like, "How do you value THC?" and it changes every time you have a conversation, and that really impacts your inventory levels at the end of the year and what that means for your bottom line.

I don't want to spend a ton of time talking about that wholesale piece of inventory but maybe for a couple minutes, you guys could talk about your experiences and the mistakes that you see people make as it relates to the, not understanding-- that understanding your inventory actually does matter for your accounting.

Jason: Inventory is probably one of those challenging pieces in cannabis. Everyone thinks, "Okay, I got to seed-to-sale system. I have to track it for state purposes. It's all going to be hunky-dory." I haven't yet to see a cannabis company, if I actually went in and tested inventory, that, A, as you said, if [unintelligible 00:27:10] on the valuation side, that they're getting all their costs up into inventory. That's A and it's hugely important for tax. I don't want to go too much into that right now but hugely important that you get all your inventoriable costs into it.

The second piece is, it's never even tracked well, between the slippage. I hate to say it, but employees do take stuff out of it, no matter how much security you have. It's just never matched up to a good degree with the seed-to-sale system when there's been a huge amount of testing. The amount of money spent by cannabis companies right now on inventory, people checking it, doing it, especially with the state regulations, and the trouble you can get into, the money that's being spent is phenomenal and it's still not really there.

On the valuation side, even in the cost valuation, getting it to be correct is crazy, because what you're doing is you might have one run, that's perfect, no slippage, great, it yields exactly what you think and the next one has white mold, and you have to destroy the whole thing. How do you track that in inventory? How do you write it off? I haven't found a big operator yet that does it really well. It's definitely going to the bottom line. You're either not doing it efficiently for tax or you're spending a ton of time and money, getting it correct at the quarter end, year end. By the way, it's not just for manufacturers, as you said. The retailers spend a lot of time on inventory management as well. Maddie, do you have anything to add?

Madeline: Because Jason is at the top of the-- he does a lot of the review work, I do a lot of the legwork for this and it's difficult to track at certain points. If you do it on a quarterly basis, daily basis, it's really important to have it at a time where people need to know what is in inventory and what is for reporting purposes. You do have state requirements, but that doesn't necessarily mean that's actually what's in inventory either. We do need to have a really good touch point for us to be able to report correctly.

TrueGreen: You guys have both touched on it a little bit and we've talked about it on another calls, but I think a lot of operators- specifically ones who haven't operated before, it's your first time or maybe even your second time or you're new at it, a lot of operators think, "This seed-to-sale system, it does my inventory for me. This is managing it." We've talked about the systems and it's why TrueGreen exists, because the systems that exist are insufficient to do the things that people actually need them to do, and more so, even from the regulatory side, people think seed-to-sale means seed-to-sale. It means very little actually.

It only means the data that's going into it. If you have employees that aren't tracking inventory correctly, or tagging plants correctly, or changing things in metric correctly, or whatever that is, then your outputs are garbage. I think it's a big piece of it, is that the systems don't fix anything. They're only as good as what you put into them.

Jason: Correct. The systems don't talk to each other. Let's just say most operators when they first start, they just jump into QuickBooks, doesn't talk to metric, doesn't talk to these other seed-to-sale systems. The seed-to-sale system is tracking very specific inventory stuff that needs to really be done for the state level or compliance level. It doesn't help the business level and the decisions you have to make at the business entity.

TrueGreen: Exactly. Then you end up adding the Leaf logix or an ERP or something, but even still, companies usually realize that after a couple years. It's like, "I've been banging my head against this wall for two years. Is there something we can do? Is there a system that will help?"

Jason: On the matching though, from the Leaf Logix to the metrics and stuff, it's not all there.

TrueGreen: I know. Absolutely. The industry on that side still has a long way to go. Even the ERPs, I think most of them get you, on a good day, 60% of the way where you need to be, and then because the standards in this industry don't exist yet, nobody does anything the same way. Nobody even packages stuff the same way month to month. You guys deal with that. If my standards and my SOPs are changing every four months, then my ERP is always going to be a little bit behind. Most of them, I think, end up getting customized, which is good, we're getting there.

Let's talk for a minute about the inventory at the dispensary level because I think that's really where, as we've talked about, TrueGreen, we really step in at the moment something is packaged until the moment it gets to the dispensary. Right now, you've got your seed-to-sale systems that don't actually go to point of sale, they go to wholesale sale. Then what happens? Then you're just flying by the seat of your pants if you're a wholesaler.

Also, from the inventory side, understanding what's sitting in your vault on shelves, how you're valuing those items that are sitting there and your aging inventory, and all of these things. As it relates to finished goods and finished product, what are some of the biggest issues that you see companies have with their inventory on an accounting standpoint?

Jason: The number one thing is, yes, it's accounting, but it really goes right to the bottom line, is the data. Most of the companies, specifically the ones that are vertically integrated, aren't tracking those finished products throughout. The finished product goes, the seed-to-sale system ends for them at that point, and they put it into their ERP platform or maybe they are tracking it in their seed-to-sale system, continuing through dispensary and through retail, but they're not using the data-- The data's not there if they're just using an ERP and it's not linking to the seed-to-sale system.

The ways you can use the data, and some of the better companies are now starting to do this, or some of them have been doing for a little bit, but they're building outside platforms or they're having weekly sales meetings to look at some of this data, where the number one thing that really is hurting the industry is that link; knowing what you're selling on a real-time basis, knowing how much inventory you have, what are the expiration dates of that inventory? Do you want to go push it?

The best analogy I use is, you go to a restaurant and they're really pushing fish, most likely that fish is going bad the next day or two. I don't think any cannabis company is really doing something like that where they're saying, "Oh my God, we produced all these six months ago, we really haven't sold well, but we need to tell our salespeople it expires in a month. They need to start now." It's almost like the burn rate of that type of stuff and the business analytics are just really not there because of that linkage.

Now, the vertically integrated ones are probably worse off because they have all that, that they could get the data if they did things correctly or they used the right programming or whatever, but it's not happening, and it's really hitting their bottom line.

Now, for the retailer that is just on an ERP platform and they're just buying goods, they're probably doing it a little bit more, but that information, most likely, is not getting back in real-time to the manufacturer saying, "This is what you need to produce more of." It's usually, they run out then they place another order or they're running low, they place another order, and then they have to go produce it, sell it, having that real-time link of saying, "Oh my God, this is flying off the shelves. Let's start now." By the way, that can change price points, that can change a lot of things from the business standpoint.

It's a little bit of accounting, but where we are seeing it most effective, which is great when we heard about TrueGreen [unintelligible 00:34:50] that real-time data is so important right now for the business because it's really not there unless they built out their entire own platform.

From an accounting point of view, a little bit different. That was the big one. That's really hurting our clients bottom line. From an accounting point of view, what's really hurting is you don't really have a full thing. You go into your B-platform, it's really not tracking where that bottle is and your inventory when you got it, all this stuff. It's tracking it, but you're not using it.

If an employee steals that, it's a slippage. You don't know it's slipped real-time. You do it when you go back to your inventory on a monthly or quarterly basis, and then you're spending a ton more time and money on, "Where is my inventory? What has happened to my inventory?" A lot of times you can fly out of compliance with those type of things.

TrueGreen: Obviously, that's one of the cool things for me. I guess two things there. We're talking about sell-through. For people that don't necessarily have experience with it, when Jason says, "I'm vertical," then I understand my ecosystem, I understand my sell-through rates. If I'm an operator producing flour and I also own a dispensary, then whatever I sell to myself with that dispensary, I know how long it's sitting on shelves. I know it sells well, I know it sells poorly. My point-of-sale system tells me that.

The majority of the industry doesn't operate that way because there are limits on the number of dispensaries you can have. If, in Ohio I have two dispensaries, there's 57 total dispensaries. When I ship to those other 55, I don't have any idea what's happening in those with my products until somebody calls and says, "I'm out of this," or, "Hey, these just expired. Are you going to pay me back for half of their value?" Well, I don't know. Wouldn't it be great if we could have that conversation four months ago? Because my sales rep knew that this inventory was getting old. We could say, "Hey, this is going to expire in four months. Why don't you guys put it on sale and we'll split the discount with you?"

There's so many things from that standpoint and that doesn't even address the idea of, right now, how are you making business decisions? You're making them based on anecdotes from budtenders who say, "This Durban is selling really well, you guys should make more of it," and then you make more of it. That is one budtender at one dispensary on one day, and then it turns out Durban wasn't what people wanted. They wanted something else, but you don't know that because you don't have these data points.

With TrueGreen and being able to create that ecosystem, if my products are going into all these dispensaries, I can see how fast they're selling. I can create reports and understand which kinds of gummies in different places are selling better and faster and flavors, and then that helps me sell better because then I can go to you and say, "Jason, stop buying these 400-milligram grape gummies, no one wants them. Buy this instead." If I can help a budtender do their job better, then I'm going to sell more of my products to them.

Jason: It's also though, I think you mentioned it, the vertical, they have more data, but none of the systems are linking together. The ERP is not linking. Usually, it's two different people that are in charge of one side of the business versus the other. What I see happening in the business is they're having a meeting once a week to talk about that instead of just that whole day meeting, that wholesales meeting, to just be like, "Here's an email, here's the data, this is what we need."

Once again, some of the bigger companies are starting to get there, but they're mostly building out their own platforms. They're really not tracking the inventory specifically from an accounting point of view. They're not really caring about it from an accounting point of view, which really makes our job harder.

TrueGreen: I'm sure. You touched on it also with the inventory from a dispensary standpoint. If the inventory gets off today, if somebody steals something, somebody gives their friend an extra couple units, whatever, or that happens periodically throughout a month, that operator doesn't know that happened, and still, that entire batch of inventory runs out.

Said differently, if I send a hundred units of MAC to a dispensary and somebody at the dispensary is stealing those, not until the system says, "You should have zero," does somebody realize there's a discrepancy here. Does that take six months? Does that take longer? Who knows? By the time it's happened, your books have been off for six months. How many skews is that happening in?

That's one of the really cool things from a functionality that we fill that gap for dispensaries, is if you're using our RFID technology, we integrate with your point-of-sales system, which means every evening, when your rep goes in there and scans that vault, it's going to send you a report that says, "Yes, this matches your point of sale," or, "No, it doesn't." If it doesn't, "These are your specific skews that are off." Which means you know if somebody stole something on that exact day, you can check the footage, and instantly, you have that data versus six months from now when nobody keeps footage for no more than 45 days, you're never going to know what's going on, this is just going to keep happening.

It's definitely a cool aspect of it. We do an exception alert if there's aging inventory. We can send that to whoever owns that data. If the dispensary down the road is using this, they can go in there, and then they do their nightly inventory, "Hey, guess what? I want to report that tells me every time a new skew is within four months of its expiration date," I get that alert, so that I know that and I can be proactive instead of everybody just running around with their hair on fire, which is what's going on, and then realizing, "Shit, this is--" Oh, sorry. This expires in six days. Sorry about that.

Jason: It's okay.

Jason: It's a sign we're just having our conversation, just the three of us.

Madeline: I think, and more importantly, it provides consistency of reporting methods, so that the clients can, instead of running around like a fire, it makes it easier for people to be able to track the information, you don't have to pull from people who are not necessarily communicating with each other. It makes it more efficient, which makes our job more efficient. Then you can make better decisions for growing and even selling, and probably better realization, probably a better pricing too.

TrueGreen: Yes, absolutely.

Jason: I'll tell you, when people come to Janover, they're not coming to us, we're not the cheap, low-level accounting firm that they just want to knock something out for $200, they come to us for our advice. The hardest part about working in cannabis is a lot of the data on the clients aren't there. It takes years of working with them to build up the data. Then all of a sudden, they'll come to us, I'm just giving an example, "Hey, can we do an audit for last year? We have this investor that wants an audit." I'm like, "Well, we can do an audit, but you came to me in May, and how do I know what your inventory was?" Doing an unqualified opinion is not going to make an investor feel good.

A lot of people don't want to pay for that audit upfront when they don't know they need it, so all these systems in place that-- Other industries have it. You think about someone that's growing tomatoes, they're not sitting there and just letting it go bad. The second they pick it, it goes into the crate, they're tagging it, they're tracking it, they're making sure that that one is going out, they're selling it, they're giving discounts if they have to, or it's off-season or whatever. Those industries have built that over decades and decades. It started before computers, they tracked it a certain way, and they built the system that it went on. Cannabis is still really in its infancy.

The best systems out there we know aren't that good yet, and there's new companies coming on that are providing these services. It's so important because I really do believe that, especially when dealing with the medical side of things, this is medicine to people. You really have to track it, you really have to know that if there was a bad batch or something, that "This is where it went to," or you find out, "Hey, you were looking over your security cameras and something happened." This is medicine. No matter if you say, oh, say it should be legal rec wise, or whatever, that's a political debate, but people that are using this are putting it into their bodies. There's a sense of urgency to make sure that the inventory is what you're saying it is as well.

TrueGreen: Yes, absolutely. The consumer engagement side of our product, I think, really speaks specifically to the public health and the public safety aspect that you're discussing. If you're using our technology, we're able to do instant recall traceability versus right now, who knows? I sent you some math on this date, and then you have to pull manifests and it's a mess. It could take you several days to figure out who has what, and then even then you don't know, but we can actually tell you the exact units that went to what dispensary, and through the integration at the point of sale, which patients purchased those. Now, I can't identify those patients, but I can tell you, "These are the purchases that were made on that date," and then the dispensary would have that information.

Then patients, when they get it, they can pull up the test results, and they can see all of those things that you're talking about, like what's in it that it's made well? I think that more and more people are looking for that information on cannabis. I think the point you made whether it's a political debate on recreational, or adult use, and medical, I think regardless of which vein you sit in, this is still a food product. It's no different than alcohol in terms of if it's recreational.

At some point, the federal government is going to step in and say there are standards, whether you like it or not, and even though you all have different programs, there are minimum requirements on the packaging. From an inventory standpoint and a traceability standpoint, we can sit and watch the federal government all we want and whether it's in six months or six years, it is coming, and it is something that I think you're starting to see people try and get ahead of is "How do I create that traceability?" I'm certain that if Smirnoff has an issue, they can figure out where all their bottles went to. That's the level that even the adult use programs have to get to.

Jason: Once again, you just mentioned legalization, but remember CBD and hemp, those are all legal now. I have a client that makes hemp gummies in, literally, their kitchen, and they sell it. The consumer is becoming a little bit more sophisticated in cannabis. He's not calling the drug dealer anymore, in college, and just he's giving you what he is giving you, and you have to accept it. People want to know where it's coming from. Organic is going very big in here. Do you want to track that this company, this manufacturing facility, or whatever?

This is what's as you said, Smirnoff is a perfect example. People trust it because it's Smirnoff. If there's a problem, they can track all their balls, they can recall it, they can tell you and if you already drank it, do whatever you have to do. I don't think that's as big of an issue in cannabis, but, once again, if you're getting it floured, and they are doing testing, and somehow it does get out, they want to know, but tracking this, it affects every single part of the business so much and the inventory, considering that inventory is what you sell.

That's what you're making your money on, and how little companies are putting into their systems and inventory is sometimes shocking to me, but also, I have to remember that this is really still in its infancy, and the person that's growing is not the expert in that, and they're looking for people to come out with solutions.

TrueGreen: This is why you have a job actually. [laughter] Welcome.

Jason: Exactly. [laughs] Yes, exactly. Listen, I would not mind it. I'm sure, as Maddy, said she does most of the work on this. I don't think she would mind, and I don't think the rest of our staff would mind having to do less of the inventory work, and that time is much better spent collecting the data and being like, "Hey, this is how we can actually help you make money rather than just accounting for your money."

TrueGreen: Cleaning up your messes. Let me help you be proactive and help you make better decisions, instead of just living in a world where I'm fixing the problems you've created. I think that's where we want the industry to get. That's what makes things less expensive. That's what makes us all more efficient. That's what makes it better for the consumer because products can be cheaper on shelves when we're not spending most of our time and money fixing things, which obviously costs more.

Jason: Something to talk about quickly is, a lot of the new laws that are coming out in states like New York, New Jersey, they're very big on microgrows. Those people are not going to have the abilities of some of the bigger companies right now that they could build out a huge Power BI platform and link all their different stuff together. It's already expensive for them, but they might be doing it, or they might be starting to do it, but these microgrowers really need good external software, good third-party service providers that can provide it because they're definitely not doing any of that.

It's probably about the guy that's buying the trim from the hemp grower doesn't know what the hemp grower is doing, whether he buys it, or he produces the CBD or hemp gummies or whatever. They're not doing anything. Once again, I can't wait to look back 10 years and see where inventory is, in 10 years from now, in cannabis, because it's going to be different. There will be a consolidation in the marketplace, but I do believe that microgrowers or small growers are going to play a huge role in cannabis, and they're not even thinking about inventory.

TrueGreen: No, they're not. I think you see it a lot. When we're talking about the top 10 biggest MSOs in the US, they're all run by business professionals. They're not run by a head grower because it's a different brain. It's like an artist and-- It's like a left brain and a right brain. We're talking about two very different people, but craft grows. We see it a lot too with the-- Social equity is obviously a huge piece of this industry. You're starting to see more of the licenses and states really prioritizing women-owned businesses and minority-owned businesses, but what that means, I don't have the experience that a CFO, that's 60 years old, has and his network.

I might need more help figuring out how to run my business efficiently. I might not even know the right questions to ask. I might not even know what I'm supposed to do. I'm just trying to figure it out. The more resources we can provide to people that are efficient, the more we can do that, the more we can say, "Let me make your business easier to run for you because I know this is not your specialty. Your specialty is growing. Here, let's integrate TruGreen, and then your inventory and your accounting becomes easier. You don't need to hire two employees to count packages, you can put that money in your pocket instead."

I think that we really have to start finding ways to help those smaller businesses, even though the loudest voices in the industry are the biggest companies, but they're not the ones that struggle the most with these things. I think that segues into the conversation of 280E, which, obviously, impacts the whole industry. I think, maybe, spend a second because I don't think that people really understand, maybe on this call they do, but I don't think most people really understand, one, what 280E is, how that impacts the cannabis industry, and then what sectors of the cannabis industry that impacts, meaning like a cultivator can write off cost of goods, but your dispensary, so the impact that has in terms of your labor costs in different areas and how you're allocating things.

Jason: 280E has been talked about so much, but I don't think people talk about it enough in terms of how it affects the industry as a whole, and it actually really, really affects the microgrowers. It disproportionately affects the women-owned and the minority-owned businesses because, believe it or not, they have less access to cash. It's really a cash flow problem. Manufacturers at-- if you're a cultivator or you're a processor, they are allowed to take more of their costs into cost of good sold. Why? Because you're producing something.

TrueGreen: Tell us what 280E is, like what does it mean?

Jason: 280E is a section of the internal revenue code that was basically set up to stop drug dealers from being able to make huge profits and take their cash and launder it or whatever. [crosstalk]

TrueGreen: Right?

Jason: Yes. Everyone knows Al Capone wasn't arrested for all the murders and everything else. He got 30 years in jail for evasion. They wanted to make it a little harder for these illegal drug dealers to make money, so they did 280E. It's just a code section. It basically says you can't take any deductions or credits against your gross income. You have a gross income and you have a--

TrueGreen: Creating revenue. That comes from a Schedule I drug.

Jason: I or II actually, and, remember, cannabis is classified as a Schedule one narcotic. The farm bill, we talked a little bit about today, the hemp and the CBD, made it that if it's less than 0.3% THC, it's now Schedule V. You're allowed to take all these deductions, and then there were some court cases that basically asked, "Okay, what does the deduction mean?" They said, "Well, the court's basically allowed cost of goods sold being deducted." They said, "You can't take all these expenses, but to get to your gross profit, you're allowed to,"

Then you have to look at 471 of the internal revenue code, which talks about inventory and inventory of a cost. I don't want to nerd out on the call about the tax code, but, basically, there's a big difference between manufacturers and distributors. Distributors, because they're buying the goods, and retail locations, they're only allowed of deduct what they buy. That's their cost of goods sold. If Catherine's producing, and I'm a retailer, I buy it from her for $5, whatever, a unit. I sell it for 10. I have 10 minus 5, that's my gross profit, that's my gross profit. That's my taxable income. I can't deduct my salespeople, my rent, my electricity.

Manufacturers can deduct a lot of those things because that goes into the product, and there's all these different rules about what's deductible, what's not, structuring is so important, but the overall thing is, thinking about that, if Catherine now sold it for $10, and it costs $5, and $5 was her profit, but $4 was her expenses, her rent, electricity, salespeople, her salary, overhead, whatever, interest if they have loans on their books. Now it's $1 left, but the taxable income is $5. This happens a lot. All of a sudden, if the tax rate-- let's say you're a corporation and your federal tax rate is 21%, you can't afford the taxes. You have to go out and raise more money.

There is a lot of money coming into the business, but this legality issue or this Schedule I or II, a lot of people don't look at it sometimes as making it legal, but maybe just descheduling it, like they did with hemp, would be a huge benefit, but 280E is definitely hurting women-owned, minority-owned businesses, tenfold times. It's not the people that have access. It's not the bigger companies, like Catherine said, that have access to the cash.

It's really sad that while the industry is doing all these things for women-owned businesses, minority businesses, smaller microgrowers, and it still is hugely hurtful and states. Some states didn't even do it. New York, we were greatly involved in trying to push the lobbyist to decouple. It's separating the laws from the federal to New York and they just did it, but it was a year after they passed it. It wasn't even in the original bill because that's not what legislators were thinking about, which is really sad.

TrueGreen: Gideon, we've got about five minutes left. If anybody has any questions, you can submit them. We'll keep talking through this and then as questions come in, we can just jump into those, but, as Jason said, the decoupling, but that still only applies to state taxes, which, at the end of the day, that's not the majority of what you're paying. If it means I get deductions in Maryland now, but my state taxes are a fraction of what my federal taxes are, it's nice and it feels good and it's really important. It's something that we've been pushing for the USCC. Also, the US cannabis council is getting more states to write their own legislation similar to what New York did.

You see, I think one was introduced in Missouri and then Massachusetts, and Ohio's working on one as well. The more you can do that, the more attention it draws to the fact that there should be something that, federally. Even if those Staten pieces don't necessarily create a huge reduction in the taxes, it is one of those "The more noise you make, the more attention you get," and if you can get more states to start passing that, I think it becomes a lot easier at the federal level who, to be honest, I don't think most legislators even understand how this impacts cannabis companies. They don't get it.

I have conversations all the time with people that are writing these regulations, and you say, "Do you understand the implication? The implication is that these publicly traded companies have to issue new shares every single year to pay their taxes. As a female-owned minority business in Maryland, with a small network, who had to take out a loan to start this business, how do you think that company is going to pay you for these taxes? They're just not. They're just going to keep losing money until you guys fix this. I think it's definitely a huge issue that really speaks to the social equity piece of the industry.

I think those sometimes get separated. I think we talk social equity in terms of licensing and we don't always talk about it from the sense of helping those people to be successful and making sure that they're set up, but just like any industry, the more money you have and the bigger your network is, the easier it is to run a business. That's just the way the world works, and that does mean that the minority-owned businesses often struggle in this vein because they don't have the same advantages.

Jason: It's really sad, in my mind, how many social equity programs in states have failed and the biggest reason they failed is access to capital and probably the number one reason they need more capital is because of taxes. It's really sad that it's the taxes, and I'm not trying to get into a higher taxes, lower taxes debate, but it's really sad when you can't get a group of people that want to work hard, that want to fulfill a dream of theirs.

Some of these states have specifically allocated certain amount of licenses to people that were affected by the cannabis rules in the past and they can't get up and running because of simple the tax code. Before we continue, I also want to ask Maddie, you're on the ground, working with these cannabis companies, day to day, what are you seeing? Anything we talked about?

Madeline: I'm seeing that to get themselves up and running, they don't really know where to start, and there's no good direction, especially being women or minority-owned women. Women, not so much, but minority. There's a lot of trust issues as well because they don't know who to go to. There's a lot of people that are salespeople, that they just will take you for a ride and they don't care. At the same time, they don't know how to get to the asks. People may be asking for sets of financials, they don't know where to go or who to talk to or what really even means, so that they can get the proper funding and so that they can get themselves set up in a way that makes sense for what their inevitable goal is to run a business.

It's knowing who to trust and knowing where to go to access these people. It's disappointing that so many people are being led in the wrong direction, and that's why I like to specialize in helping women and minorities because I want to be able to help these businesses, not take them for a ride.

TrueGreen: It's important that you see it and, Jason, you touched on most haven't been successful, and it's like the why, because somebody gets handed the golden ticket and then they don't know where to cash it, and then somebody comes along and says, I'll split that golden ticket with you, and they say "Yes." Then you see a lot of minority-owned businesses that end up giving pieces of their company away to people on a hope and a dream that they can help them be successful.

Then that's also not successful because this person wasn't somebody that you should have trusted to do all these things, or because of the fact that, maybe, the agreement was not advantageous to the person who was signing it, but they don't have good resources to vet this and say, "Hey, Maddie, can you tell me if this is a terrible idea," right? I think the more Maddies we can get that will help the financial side, specifically. It's true. There aren't a lot of companies that are trying to focus on helping. I talked about it with John, who's on our team, and the idea that, what's next? Okay, we accomplished getting people licenses, but then what's next? Who knows? People don't know how to just start businesses, guys, that's not something you learn growing up, especially if you come from a socioeconomic status that it's not something that is intuitive to you. We do have to have infrastructures in place so that when somebody gets it, it's like, "Okay."

I, obviously, am going to participate in figuring this out, but here's a helpful guide, here are resources, and I think New York actually is one of the few states that I think is really trying to put programs in place and resources in place so that when somebody gets a license, it's like, "Okay, here's a package that includes everything you could need, from a contractor to an accountant to your window treatment, Everything you need, here are resources, and they're vetted, and they're trusted, and they aren't going to take advantage of you, and they've all agreed to give discounts to minority businesses." I think those are great programs, and I think the more we can implement that kind of stuff, the better the industry will be as a whole. Not that this has anything to do with accounting, but it is--

Jason: I think New York is also setting up some funds that are going to these minority businesses, and I think that's really important that the states and the federal government get involved with it, they give low-interest-rate loans or whatever to them. I'm not saying do something that you wouldn't do in a normal course of business for the governments, but I think that, in the beginning, a lot of these programs didn't have the funding side of it, and I think that's really important.

Madeline: Just to touch on loans very quickly, some of the loans that I've heard are 12%, 15%, 20%. They're literally robbing people of their hard-earned money, and it's like, you point people in a good direction. It's very important and [crosstalk]

Jason: And not deductible.

TrueGreen: Yes, I think that's-- We didn't really talk on that as it relates to 280E, but that is another huge portion of it, right? The cannabis industry cannot go out and just get a normal financing loan. It doesn't exist because banks are afraid to give the loan because of the fact that it's federally illegal, so then unless you have a network that has millions and millions of dollars in it, where are you supposed to come up with this from? You aren't, and then what happens is there are a few banks and institutions who have started doing loans or sale-leaseback or things like that, but they aren't favorable. They've got 12% interest rates because they have all the leverage, and that's just that's not, long term, good business, but it does become a situation where it's like, "Well, I can agree to take this sale-leaseback that locks me in for five years, and is that 12% interest window, like Maddy said, or I can not open my business." That's not a great place to put people in.

Jason: Or they already opened their business, and they already put money into another trap, and, probably, 12% right now in Cannabis is good, but my thing is, 12% might not be so bad if you deduct the interest, so` it's really the government putting that pressure on, so how much more is that loan costing you than another business? Even if you'd have to take the 12% loan, and I understand why the rates are a little bit higher, they're federally illegal and stuff, but then you can't deduct it. It's hard, and then you add into it, everything else we talked about, Catherine, that you're not maximizing your profit, because you don't have all the data for your inventory.

TrueGreen: Yes.

Jason: People are going out. I've heard some people going out and paying upwards of 30% for the ERC, the credits that we're talking about. Unbelievable that someone would actually go and pay somebody that, and the work is not that much that they should be charging 30%. Obviously, there's a small one, 30%, maybe, because the work is upfront, but I think the most we were charged is probably 12% on something, but I can't believe that cannabis companies, and they just don't know that that's wrong, and it's incredible that they go back. I can't believe the government allows it.

TrueGreen: Yes, no. Well, I think that's a fun game, is that the government doesn't allow it because they don't allow it at all. We're all kind of out here fending for ourselves right now until somebody says, "Yes, this is legal," and now you have all of the normal protections and conversations that every other industry has. All right, I think we've got a few minutes more, but I appreciate you guys chatting with me today. As always, it's nice to see both of you.